New Proposed Regulations Would Ease GILTI Tax Burden on Non-Corporate Taxpayers

If finalized, new proposed regulations would exclude a CFC’s income taxed at an effective rate of 18.9 percent or higher from the definition of GILTI and thereby greatly reduce the requirement of U.S. individuals to pay current taxes on CFC income prior to receiving a distribution. The proposed changes bring the GILTI rules into line with the original intent of the 2017 Act by only currently taxing income of a CFC that is subpart F income, distributed to the shareholder, or earned from intangible assets in a jurisdiction with a lower tax rate than the United States.

As part of the 2017 Tax Cuts and Jobs Act (the “Act”), Congress implemented a new anti-deferral tax on certain earnings of a controlled foreign corporation (“CFC”) known as global intangible low-taxed income (“GILTI”). Similar to the taxation of subpart F income, a 10-percent or greater U.S. shareholder of one or more CFCs is required to include GILTI currently as taxable income (in addition to any subpart F income), regardless of whether a distribution is received. The tax on GILTI essentially serves to tax U.S. shareholders currently on a CFC’s earnings to the extent such earnings exceed a 10 percent return on the CFCs tangible assets.

Non-corporate taxpayers with foreign subsidiaries have been hit hard by the Act. Where a non-corporate U.S. shareholder owns a CFC, the taxable income of the CFC (that is not otherwise included as subpart F income) must be taken into account as GILTI at the U.S. shareholder’s ordinary income rates. Unlike U.S. corporate taxpayers, individuals do not benefit from a fifty-percent deduction available to corporations or the ability to offset the resulting U.S. taxes on GILTI with associated foreign tax credits. Though limited relief from the GILTI tax has been available to some U.S. individual taxpayers under Section 962 of the Code, in some situations this ameliorating election is not available. The proposed regulations, once finalized, will grant significant relief to these non-corporate U.S. shareholders.

Recognizing that the purpose of the tax on GILTI is to ensure that “a minimum tax” be paid on offshore low-taxed income, many practitioners were surprised that the GILTI rules adopted under the Act generally tax a U.S. shareholder even when the CFC pays income tax in its home jurisdiction at or above the tax rates imposed by the United States. This result is even more surprising given the long-standing “high-taxed exception” that applies for subpart F purposes to exclude from subpart F income items taxed at a sufficiently high rate in the foreign jurisdiction. Nevertheless, under the current GILTI provisions, only a very limited exception exists for high-taxed income (Section 951A(c)(2)(A)(i)(III) of the Code). The statutory exception arguably only excludes high-taxed income if such income would otherwise be subpart F income. This at least, was the viewpoint of the IRS as set forth in the preamble to prior proposed GILTI regulations (see REG-104390-18).

Due to the unavailability of the high-taxed income exception with respect to non-subpart F income, many U.S. individuals (including S corporation shareholders and partnership partners) have been required to pay tax on GILTI with respect to CFCs without regard to the fact that the CFC is operating and paying tax in a foreign jurisdiction at a tax rate that equals or exceeds the U.S. tax rate. Further, in some instances, taxpayers have the perverse incentive to plan for income to be subpart F income in order to take advantage of the existing high-taxed exception. These aspects of the GILTI rules have been highly criticized and practitioners have frequently requested an expansion of the high-taxed exception to provide a broader exclusion from GILTI.

If finalized, the proposed regulations (REG-101828-19) issued on June 14, 2019 would substantially expand the high-tax exception for purposes of calculating GILTI. Under the proposed regulations, taxpayers may elect to exclude high-taxed income from GILTI regardless of whether the underlying item of income would be includible as subpart F income (absent the subpart F high-tax exception). Accordingly, income that is subject to a tax rate in a foreign jurisdiction that exceeds 90 percent of the U.S. tax rate imposed on corporations (currently 18.9 percent) generally may qualify for the new exclusion.

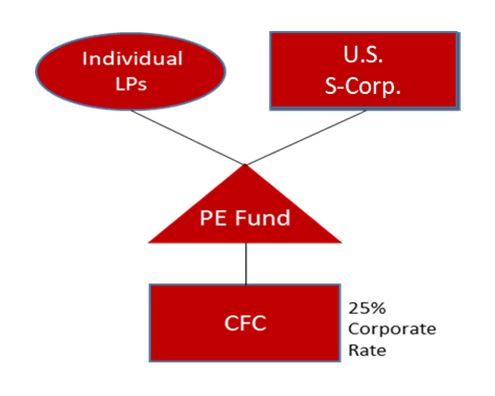

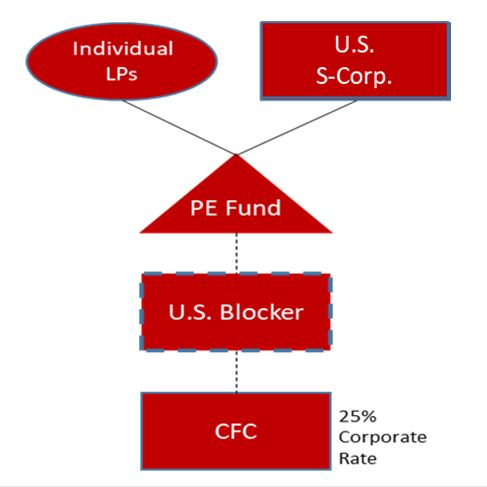

Since the passage of the Act, U.S. non-corporate taxpayers with foreign operations have been scrambling to restructure their operations to take advantage of mitigation techniques with respect to the GILTI tax. As noted above, the GILTI tax is seen as especially onerous for such taxpayers because they generally do not benefit from the special GILTI deduction, foreign tax credits, or in many instances, the ability to utilize a Code section 962 election. One common technique to reduce or eliminate the GILTI tax has been to insert a blocker corporation between a U.S. flow-through entity and the CFC.

| Structure Prior to the Act | Structure Under the Act |

|

|

Unlike the LPs in the example, the blocker corporation is entitled to the special 50 percent GILTI deduction described above and generally has the ability to claim foreign tax credits against the GILTI tax. In many instances, however, this solution is imperfect because even though the U.S. blocker would eliminate the GILTI tax, any ultimate liquidity event with respect to the CFC would either result in two levels of tax or would require the PE Fund to find a buyer willing to purchase the U.S. blocker (which almost certainly would limit potential buyers to U.S. persons). Further, if the PE Fund has tax-exempt LPs, their pro rata share of any tax incurred by the U.S. Blocker would reduce the tax-exempt LP’s overall return even though exempt LPs are not subject to tax on GILTI (potentially putting individual fund managers and their tax-exempt LPs at odds). If finalized, the proposed regulations would substantially mitigate such conflicts where the applicable foreign jurisdiction taxes the CFC’s income at an effective tax rate above 18.9 percent—in the example above, this relief would render the U.S. Blocker unnecessary because the CFC is subject to a foreign income tax of 25 percent.

Because the proposed regulations are not currently effective and do not permit taxpayers to rely upon them in proposed form, the potential expanded relief from GILTI tax for high-taxed income remains unavailable. Practitioners, however, have been urging the IRS and Treasury to grant retroactive relief to taxpayers who suffered significant tax burdens because of the tax on GILTI during 2018, or at a minimum, ensure that taxpayers may apply the new regulatory provisions for the current 2019 taxable year.

In This Article

You May Also Like

For Colorado Business Owners, Expanded and Enhanced Tax Credits Make Transition to Employee Ownership Through ESOPs Even More Attractive IRS Finalizes New Group Exemption Rules: What Exempt Organizations Need to Know