New Executive Order Requires Outbound Investment Review System

On Aug. 9, President Biden issued an Executive Order (EO or Order) titled Executive Order on Addressing United States Investments in Certain National Security Technologies and Products in Countries of Concern. This EO authorizes the Secretary of the Treasury to ban or restrict American investments in certain Chinese entities. In the national security community, this issue has been hotly debated for some time now.

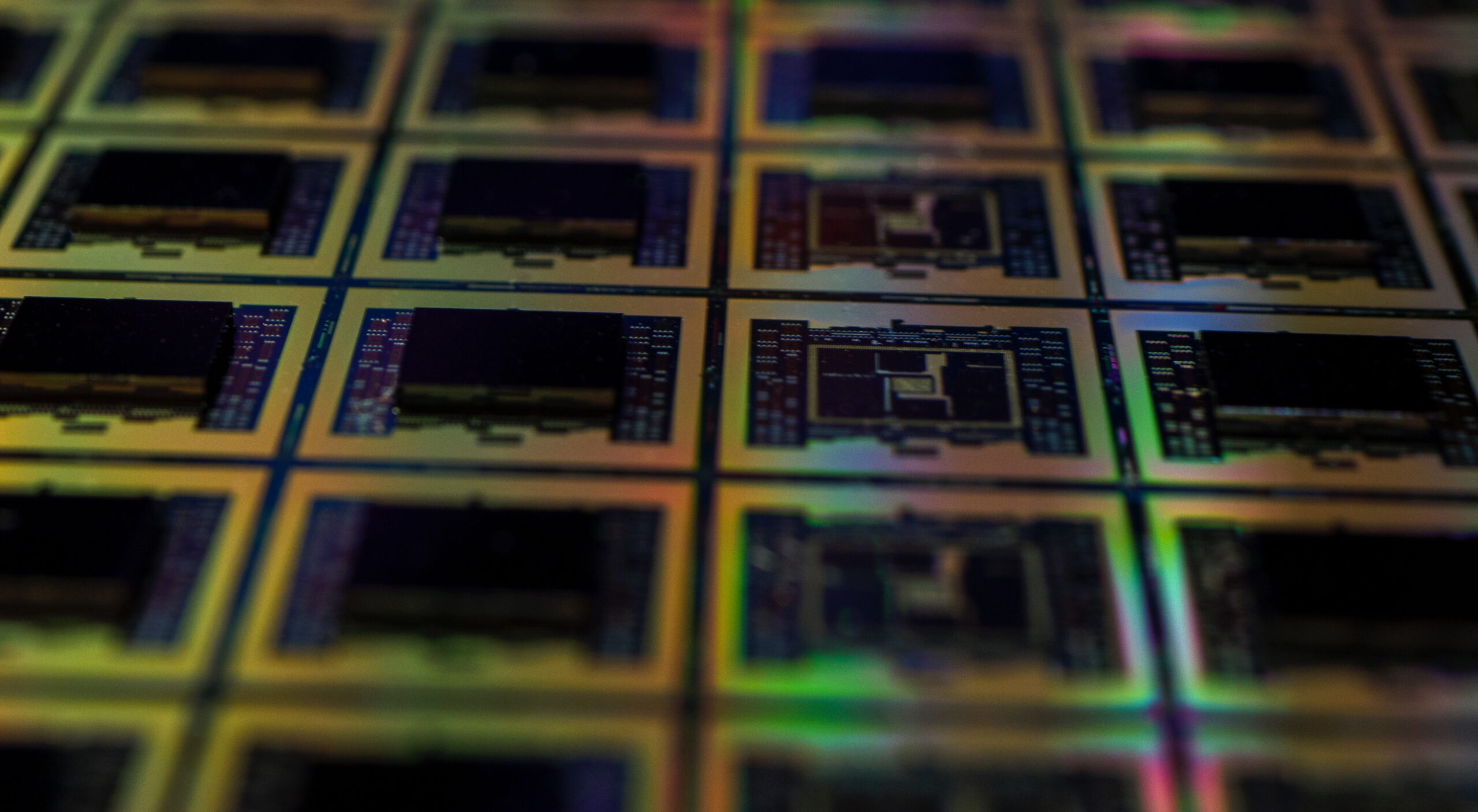

This Order pertains to businesses in three sectors: semiconductors and microelectronics; quantum information technologies; and some artificial intelligence systems. That same day, the Treasury Department issued an advance notice of proposed rulemaking (the ANPRM) to launch this EO’s implementation.

In some quarters, this EO is being called a “reverse-CFIUS” move, thereby referring to the now-familiar Committee on Foreign Investment in the U.S. CFIUS, as has been recounted by Taft numerous times, concerns the U.S. government’s review of foreign entities’ transactions seeking to acquire U.S. assets in a way that risks the national security of the U.S.

This EO claims to stop U.S. capital and subject-matter expertise from assisting China and Chinese entities that develop technologies that could compromise U.S. national security, principally by aiding China’s military overhaul. This Order focuses on private equity, greenfield investments, venture capital, and joint ventures.

In a separate letter addressed to the Speaker of the U.S. House of Representatives, President Biden asserted that he was trying to stymie meteoric Chinese advancement pertaining to “sensitive technologies and products critical to the military, intelligence, surveillance or cyber-enabled capabilities.” These advancements, the President maintains, “constitute[] an unusual and extraordinary threat to the national security of the United States.”

Highlights of This Order and the Ensuing ANPRM:

- Capacious Scope of “U.S. Persons”: Regardless of their location, “U.S. persons” will be expected to follow the prohibition and notification strictures. Moreover, a U.S. person refers to any U.S. citizen, lawful permanent resident, entity organized under U.S. federal or state laws, and any person in the U.S. Furthermore, this EO empowers the Treasury Secretary to obligate U.S. persons: (1) to comport themselves in certain ways with respect to foreign entities over which they exercise control; as well as (2) in particular circumstances where U.S. persons “knowingly direct[] transactions” by non-U.S. persons.

- Kinds of Covered Transactions: This EO pertains only to these types of transactions that might convey “intangible benefits”: joint ventures; acquiring equity such as through private equity, mergers and acquisitions, and venture capital; greenfield investments; and specific debt financing transactions such as those that may be converted to equity.

- Outright Bans: U.S. persons may not invest in these Chinese markets:

- Semiconductors and Microelectronics. The ANPRM expresses concerns about “(i) specific technology, equipment, and capabilities that enable the design and production of advanced integrated circuits or enhance their performance; (ii) advanced integrated circuit design, fabrication, and packaging capabilities; and (iii) the installation or sale to third-party customers of certain supercomputers, which are enabled by advanced integrated circuits.”

- Quantum Information Technologies. Chinese companies involved with (i) quantum computers and components — specifically, in the ANPRM’s words, “the production of a quantum computer, dilution refrigerator, or two-stage pulse tube cryocooler”; (ii) quantum sensors — “quantum sensing platforms designed to be exclusively used for military end uses, government intelligence, or mass surveillance end uses”; and (iii) quantum networking and quantum communication systems — “a quantum network or quantum communication system designed to be exclusively used for secure communications, such as quantum key distribution”.

- Artificial Intelligence (AI). In the ANPRM’s diction, “[i]f the Treasury Department were to pursue a prohibition in this category, a potential approach is to focus on U.S. investments into [Chinese companies] engaged in the development of software that incorporates an AI system and is designed to be exclusively used for military, government intelligence, or mass-surveillance end uses.” Otherwise, “‘primarily used’ could [supplant] ‘exclusively used.’”

- Prospects for Heightened Notification: The Treasury Department might require notification for a more expansive cadre of investments in the Chinese semiconductor and microelectronics market as well as the AI space.

- Countries of Concern: Although the EO, at this time, names only the People’s Republic of China — including Hong Kong and Macau —as a “country of concern,” that terminology might one day go on to encompass other countries. This Order or its successors might then be applicable to specific sectors in those countries of concern as well.

- Submitting Comments to Treasury and Monitoring Future Developments in This Space: U.S. fund managers and those interested in investing in the aforementioned sectors of the Chinese economy should consider submitting comments to the Treasury during the currently running 45-day comment period before the Treasury comes back with a Notice of Proposed Rulemaking (NPRM). They should also watch this space for shifting and evolving developments here. Notably, Treasury has declared that it might — but not necessarily will — exclude from this outbound investment review scheme some index funds, exchange-traded funds, publicly-traded securities, mutual funds, certain types of investments a limited partner makes, “intracompany transfers of funds from a U.S. parent company to its [Chinese] subsidiary,” and more.

- Macro Trend: In addition to the Section 301 tariffs, imposed under the Trade Act of 1974, that remain in partial effect, this EO’s prohibitive and notification-requiring strictures further restrict U.S.-China trade. This Order and the related ANPRM signal a new era in the U.S. government’s regulation of outbound investments.

In This Article

You May Also Like

Five Steps To Protect Your Business From Spoofed Email Fraud Fed. Circ. Skinny Label Ruling Guides On Infringement Claims