2020 Gaming Bill Passed by the Illinois General Assembly

I. Background

On May 23, 2020, in the final hours of the First Special Session of the 101st General Assembly, the Illinois General Assembly passed Senate Bill 516, as amended by House Amendments 5, 6, 7, and 9 (the “bill“). The bill amends provisions of the Illinois Gambling Act, Sports Wagering Act, and Video Gaming Act. Governor Pritzker is expected to sign the bill into law.

II. Overview of the Bill

(A) Amendments to the Illinois Gambling Act (IGA)

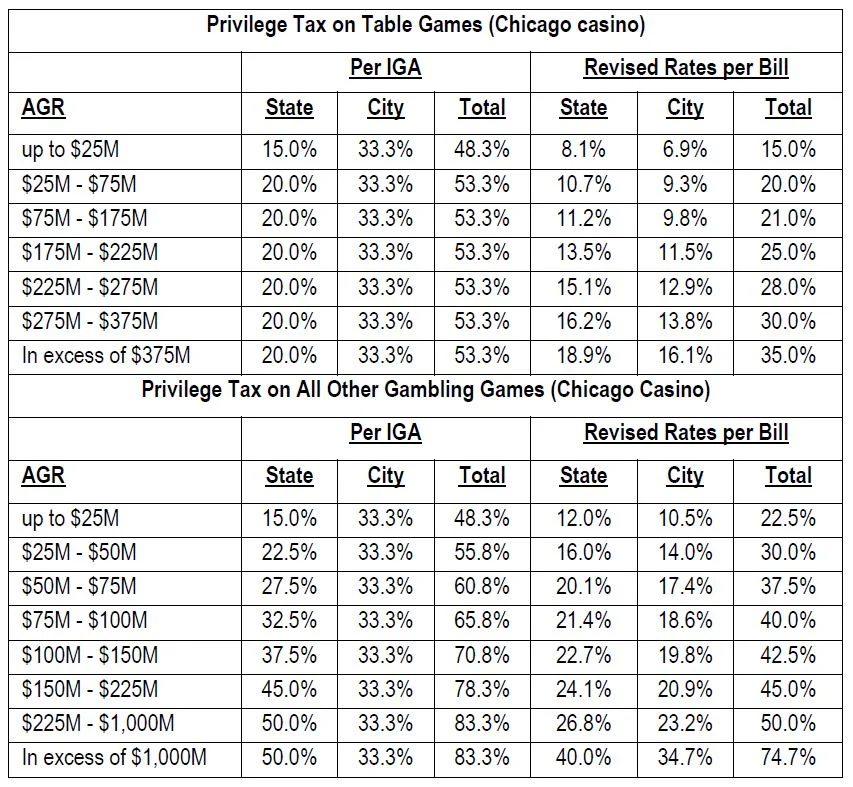

- Gaming privilege tax rates for a Chicago casino are restructured to make it financially feasible. Per the IGA, all Illinois riverboats, casinos and racetrack casinos (racinos) pay the state a gaming privilege tax based on adjusted gross receipts (AGR) earned from the operation of table games and other gambling games. In addition to this gaming privilege tax, the Chicago casino would pay an additional 33 ?% privilege tax on its total AGR. Per the City of Chicago Casino Financial Feasibility Analysis (dated Aug. 12, 2019), prepared for the IGB by Union Gaming Analytics, a Chicago casino would not be financially feasible under this tax structure. The bill revises the privilege tax structure for a Chicago casino to make it financially feasible. This provision is commonly referred to as the “Chicago casino fix.” Per the bill, the revised privilege tax structure for a Chicago casino is as follows:

- The payment date for the gaming position fee is extended to July 1, 2021 for Illinois’s existing 10 casinos. Under the IGA, each of Illinois’s existing 10 casinos may elect to increase the total number of gaming positions offered at the casino from the current limit of 1,200 gaming positions to up to 2,000 gaming positions. If such a casino desires to increase its gaming positions in excess of 1,200 gaming positions, it must pay a position fee for each additional gaming position added. The per-position fee is (1) $17,500 per position if the casino is located outside of Cook County or (2) $30,000 per position if the casino is located within Cook County. The IGA provides that the per-position fees must be paid by July 1, 2020. The bill extends this payment date to July 1, 2021.

- The Illinois Gaming Board (IGB) is authorized to re-bid casino licenses if there are no applications pending for such licenses. The IGA authorizes the IGB to issue six new owners licenses for the operation of a casino in each of the following locations:

- City of Chicago.

- City of Danville.

- City of Waukegan.

- Any one of the following townships of Cook County: Bloom, Bremen, Calumet, Rich, Thornton, or Worth.

- City of Rockford.

- Williamson County adjacent to Big Muddy River.

The bill amends the IGA to provide that if, at any time after June 1, 2020, there are no applications pending before the IGB seeking an owners license for a casino to be located in any one of these locations, then the IGB may re-open the license application process for such location. This provision is commonly referred to as the “Danville fix.”

- The time period for payment of “Reconciliation Payment” is extended from two years to six years. Under the IGA, each new casino (and racino) must make a “reconciliation payment” to the state three years after commencing operations as a casino or racino. The reconciliation payment is equal to 75% of the casino’s (or racino’s) AGR from gambling operations for the most lucrative 12-month period of such operations minus the gaming position fee previously paid by the casino or racino. Similarly, each existing casino that elects to increase its gaming positions above 1,200 positions must make a reconciliation payment to the state three years after any new gaming positions begin operating. In this case, the reconciliation payment is equal to 75% of the casino’s “average gross receipts” for the most lucrative 12-month period of operations minus the gaming position fee previously paid by the casino. “Average gross receipts” is (1) the increase in AGR for the most lucrative 12-month period of operations over 2019 AGR, multiplied by (2) the percentage derived by dividing the number of new gaming positions that the casino obtained by the total number of gaming positions operated by the casino. In all cases, with the consent of the IGB, these reconciliation payments may be paid in annual installments over two years, but the installment payments must include a market rate of interest as determined by the IGB. Per the bill, the reconciliation payments may be paid in annual installments over six years on an interest-free basis.

(B) Amendments to the Sports Wagering Act (SWA)

- The payment date for the master sports wagering license fee is extended to July 1, 2021 for Illinois’s racetracks and existing 10 casinos. Under the SWA, any of Illinois’s racetracks or existing 10 casinos that obtain a master sports wagering license from the IGB is required to pay the license fee for such master sports wagering license on or before July 1, 2020. The bill extends this payment date to July 1, 2021.

(C) Amendments to the Video Gaming Act (VGA)

- Video gaming terminals (VGTs) may be operated at the Illinois State Fairgrounds and the DuQuoin State Fairgrounds by a licensed terminal operator procured by the Illinois Department of Agriculture. Under the VGA, the IGB is authorized to issue a licensed establishment license to a concessioner to operate (1) up to 50 VGTs at the Illinois State Fairgrounds during the dates of the Illinois State Fair and (2) up to 30 VGTs at the DuQuoin State Fairgrounds during the dates of the DuQuoin State Fair. The bill provides for the IGB to issue the licensed establishment license to the Illinois Department of Agriculture and for the Department to select, under the Illinois Procurement Code, the IGB-licensed terminal operator(s) to operate the VGTs at the Illinois State Fairgrounds and the DuQuoin State Fairgrounds. This provision is commonly referred to as the “State Fairgrounds fix.”

In This Article

You May Also Like

Illinois’ Wagering Woes: Tax Hikes and the End of Wagering on Illinois College Sports Summary of Ohio Sports Gaming Law